The Company's investment approach is based on the principles of responsible investment, aimed at considering ESG factors, environmental, social and governance, in investment decisions, for better risk management and building long-term sustainability.

As part of implementation of transformation program, “Samruk-Energy” JSC has introduced the best investment activity management practices, including:

- management of the Company's portfolio of projects and activities, which enabled to significantly improve the distribution of financial resources by increasing the share of profitable projects in the total portfolio of projects and activities;

- project management, which will raise the level of control at the stage of implementation of investment projects (budgets, deadlines).

The Company's investment projects are based on the principles of business viability and long-term interests, as well as return on capital. The company is aware of its responsibility and strives to contribute to the development of society by supporting the principles of ESG, as well as plans for sustainable development.

In assessing the ESG, the Company is guided by the provisions of the Corporate Governance Code and the best-in-class international standards recognized by the international community, such as the UN Sustainable Development Goals, the Global Reporting Initiative, IFC and EBRD Environmental and Social Standards, the UN Principles for Responsible Investment, etc.

The company adheres to the following key principles directly related to investments:

- incorporating ESG criteria in the investment analysis and decision making process;

- compliance with the Republic of Kazakhstan legislation and proper use of confidential information;

- preparation of annual reports, including financial statements, reports on sustainable development, including ESG factors, in accordance with generally recognized international or national auditing standards;

- availability of formal risk identification, assessment and management system.

The advantages of compliance with the ESG principles are:

- informed investment decisions through an understanding of essential ESG factors, corresponding potential liabilities, costs and impact on financial performance, and potential opportunities for value creation;

- minimizing exposure to reputational or legal risks;

- ensuring that adequate systems are in place to assess and monitor the effectiveness of the Fund's and portfolio companies' compliance with ESG principles, compliance with applicable ESG requirements, and management of associated investment risks;

- laying the groundwork for ongoing engagement with companies to discuss, assess and manage the risks and impacts of ESG, and to identify and seize opportunities;

- Demonstrate proper consideration and management of relevant ESG factors for corresponding stakeholders.

Based on the results of the analysis conducted, a list of capital projects was formed in 2021, including "green" energy transition projects included in the Company's Development Strategy for 2022-2031. (learn more on the website of “Samruk-Energy” JSC: www.samruk-energy.kz).

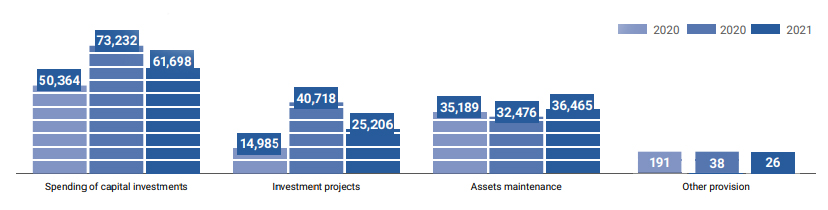

INVESTMENT COSTS,mln tenge

The investment program is financed using own funds, debt financing of international financial organizations and second-tier banks of the Republic of Kazakhstan.

|

|

2018 actual |

2019 actual |

2020 actual |

|

TOTAL |

50,364 |

73,232 |

61,698 |

|

own |

42,836 |

35,129 |

59,336 |

|

borrowed |

7,528 |

35,122 |

1,993 |

|

State budget funds |

|

2,982 |

368 |

Capital expenditures for maintenance of production assets are aimed at repairing the main and auxiliary equipment, as well as acquiring fixed assets of a production nature to ensure the reliability of the power plants.

“Bogatyr Komir” LLP, “Ekibastuz SDPP-1 named after Bulat Nurzhanov” LLP, “Alatau Zharyk Company” JSC and “Almaty Power Plants” JSC account for the main share of capital expenditures for maintenance of production assets and other fixed assets. At year-end 2021, expenditures for maintenance of production assets covered major and regular comprehensive repairs of power units of “Ekibastuz SDPP-1 named after Bulat Nurzhanov” LLP, as well as reconstruction of distribution power grids, construction and reconstruction of transmission lines and substations, and other costs for repair of production assets and other fixed assets of “Alatau Zharyk Company” JSC. Capital expenditures of production nature of “Bogatyr Komir” LLP and “Almaty Power Plants” JSC were used to purchase fixed assets that are directly involved in operations and for carrying out major overhauls.

Capital expenditures of an administrative nature and other investments were planned for purchasing fixed assets and intangible assets that do not directly influence production activities, as well as for activities aimed at implementing “Samruk-Energy” JSC Transformation program.