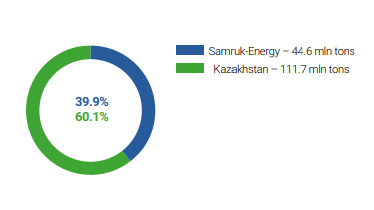

According to the Statistics Committee of the RK Ministry of National Economy, the country’s coal production amounted to 111.7 mln tons of coal in 2021 (excluding coal concentrate) or 102.3% against the same indicator in 2020 (109 mln tons of coal).

Power generating coal market in Kazakhstan is relatively fragmented – the major players are “Bogatyr Komir” LLP (“Samruk-Energy” JSC and “RUSAL” UC), “EEC” JSC (ERG), “Shubarkol Komir” JSC (ERG), “Kazakhmys Corporation” LLP, “Karazhyra” JSC, “Angrensor Energy” LLP.

|

№ |

Δ, 2021/2020% |

2019 |

2020 |

2021 |

Δ, 2021/2020 % |

|

1 |

Pavlodar |

68,364.9 |

67,049.9 |

66,932.3 |

99.8 |

|

2 |

Karaganda |

34,217.1 |

33,614.6 |

35,362.6 |

105 |

|

3 |

East-Kazakhstan |

8,157.7 |

8,388.8 |

8,804.1 |

105 |

|

Total across RK |

111,083.2 |

109,227.6 |

111.099 |

102 |

|

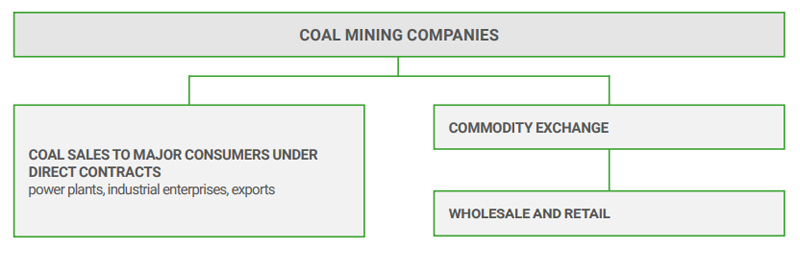

GENERAL SCHEME OF COAL SALES

Power systems of Nur-Sultan, Almaty, Karaganda, Petropavlovsk, Pavlodar, Stepnogorsk cities and Ekibastuz SDPP-1, SDPP-2 are among the major consumers of “Bogatyr Komir” LLP in Kazakhstan.

To receive coal, the power plants of the Republic of Kazakhstan arrange the transportation of coal from Ekibastuz station (Bogatyr Komir, LLP) to the destination station using their own resources; to this end they conclude contracts with various freight forwarding companies, which engage car owners (operators) to arrange transportation.

Following the results of transactions on the stock exchange, municipal coal is shipped in two ways: by railway and motor transport. Boiler houses in rural areas are the consumers; Ekibastuz coal is a fuel specified on their nameplates.

According to the 2021 results, the Company's share amounted to 39.9% of the total coal mined in Kazakhstan and 66.6% of the volume of coal mined in the Ekibastuz coal basin.

COAL MINING

In January-December 2021, “Bogatyr Komir” LLP produced 44,632 thous. tons, which is 0.5% less than in the corresponding period of 2020 (44,848 thous. tons).

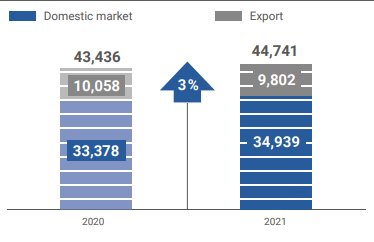

44,741 thous. tons were sold in January-December 2021, including:

- to the domestic market of the Republic of Kazakhstan 34,939 thous. tons, which is 5% more than in the corresponding period of 2020 (33,378 thous. tons);

- for export (Russian Federation) – 9,802 thous. tons, which is 2.5% less than for the corresponding period of 2020 (10.058 thous. tons).

Sales of coal to consumers between 2019 and 2021

|

№ |

Region |

Sales volume, thous. tons |

Δ, % 2021/2020 |

||

|

2019 |

2020 |

2021 |

|||

|

1 |

“APP” JSC |

3,338 |

3,291 |

2,997 |

91.1% |

|

2 |

“Karaganda Energocenter” LLP |

3,417 |

3,500 |

2,777 |

79.4% |

|

3 |

“Astana-Energia” JSC |

3,779 |

3,837 |

4,326 |

112.8% |

|

4 |

“Pavlodarenergo” JSC PCHP-2, 3 |

3,004 |

2,494 |

2,855 |

114.5% |

|

5 |

“Stepnogorsk CHP” LLP |

986 |

950 |

995 |

104.6% |

|

6 |

“ESDPP-1” LLP |

10,937 |

11,553 |

13,374 |

115.8% |

|

7 |

“ESDPP-2 Plant” JSC |

3,203 |

3,007 |

3,676 |

122.3% |

|

8 |

“Bassel Group LLS” LLP |

622 |

539 |

416 |

77.1% |

|

9 |

“SevKazEnergo” JSC |

2,949 |

2,773 |

2,254 |

81.3% |

|

10 |

“Ekibastuzteploenergo” LLP |

499 |

481 |

542 |

112.6% |

|

11 |

MUS based on the REM “Kokshetau Zhylu” |

281 |

316 |

336 |

106.5% |

|

12 |

Household |

775 |

637 |

391 |

61.4% |

|

Total for the domestic market of the RK |

35,572 |

33,378 |

34,939 |

104.7% |

|

|

13 |

Reftinsk GRES |

10,893 |

10,058 |

9,802 |

97.5% |

|

Total for export to the RF |

|

10,058 |

9,802 |

97.5% |

|

At the end of 2021, the volume of coal sales amounted to 44,741 thous. tons, which is 3% or 1,305 thous. tons more than the same period.

Increase in coal sales volumes in the domestic market by 1,560 thous. tons or 5% is because of an increased demand. At the same time, the decrease in the volume of coal sales in the foreign market by 256 thous. tons or 3% is due to the lack of an agreement on coal price.

The stripping rate for 2021 was 0.73 m3/t with 0.84 m3/t in the same period.

Forecast for the future period:

The volume of coal sales in the 2022 forecast will drop by 741.2 thous. tons, or by 2% compared to the 2021 actual.

BOGATYR KOMIR COAL SALES, (thous. tons)

Coal sales price

|

Name |

2019 actual |

2020 actual |

2021 actual |

2022 forecast |

2023 forecast |

|

“Bogatyr- Komir” LLP |

2,120 |

2,311 |

2,292 |

2,553 |

2,945 |

“Bogatyr- Komir” LLP coal sales price is approved independently by the price list for consumers of the Republic of Kazakhstan for 3 groups of consumers (energy sector at the KTZh junction station, energy sector at the coal collection station, utility needs). Regulation is performed in line with the Entrepreneurial Code of CRNM and PC under MNE.