“Bogatyr Komir” LLP (Forum Muider B.V. – 100%)

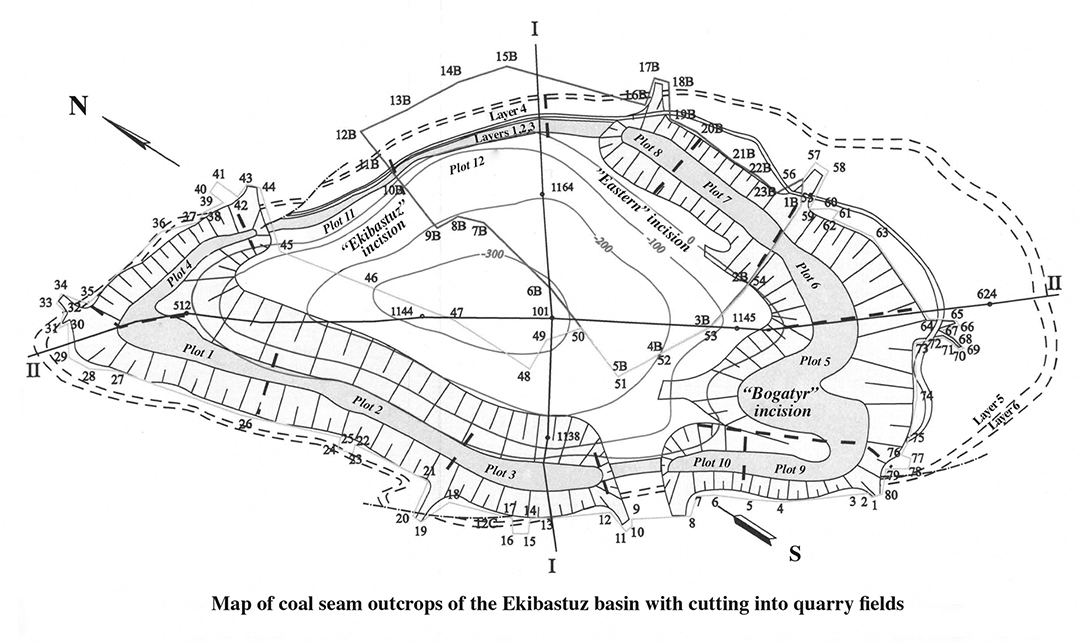

“Bogatyr Komir” LLP is one of the largest enterprises in the world in terms of open-pit coal mining. “Bogatyr Komir” LLP accounts for 59 percent of all coal mined in the Ekibastuz coal basin and circa 40 percent of the total coal production in the RK.

“Bogatyr Komir” LLP approved coal reserves amount to circa 2.9 bln tons. Coal reserves at “Bogatyr Komir” LLP were approved up to minus 200 m horizon (depth from the surface is 400 m). With the current capacity of the enterprise coal reserves will be enough for no less than 70 years of operations.

“Bogatyr” coal mine, commissioned in 1970, exploits coal reserves in the fields (sections) 5,6,9,10. The depth of the coalmine reached 280 m from the surface (mark: the horizon is minus 80 m according to the Baltic measurement system from the Baltic Sea level).

“Severny” coalmine, commissioned in 1954, coal is mined in the fields (sections) 1,2,3,4. The depth of the mine reached 230 m from the surface (mark: the horizon is minus 30 m according to Baltic measurement system from Baltic sea level).

The main industrial layers of Ekibastuz field are layers 1, 2, 3, 4 with an average thickness of 160 m and a depth of up to 670 m. The total coal reserves of the field are more than 9 bn tons.

Confirmed coal reserves of “Bogatyr” and “Severny” coal mines of “Bogatyr Komir” LLPmln tons

|

Seam |

Confirmed reserves |

Seam |

Confirmed reserves |

Seam |

Confirmed reserves |

|

“Severny” mine (sections 1,2,3,4) |

“Bogatyr” mine (sections 5,6,9,10) |

Total for “Bogatyr Komir” LLP |

|||

|

1 |

199.8 |

1 |

198.1 |

1 |

397.9 |

|

2 |

298.1 |

2 |

332.8 |

2 |

630.8 |

|

3 |

662.2 |

3 |

739.4 |

3 |

1,401.7 |

|

4 |

205.9 |

4 |

278.7 |

4 |

484.6 |

|

5 |

1,336.0 |

Total: |

1,549.0 |

Total: |

2,915.0 |

A supply chain of the entity

“Bogatyr Komir” LLP extracts KSN grade (coking caking slightly metamorphosed) coal with an average calorific value of ~ 4,000 kcal / kg, ash content ~ 43%, moisture ~ 5%.

The entity supplies thermal coal to generating facilities of the RK domestic market and for export to the RF, as well as the supply of household coal to the RK domestic market. Coal is sold to thermal power plants of the Republic of Kazakhstan under direct contracts for the supply of coal, to the power plants of the Russian Federation through a trader.

Household coal is sold through commodity exchanges in accordance with the Order of the Minister of National Economy of the Republic of Kazakhstan dated February 26, 2015

No. 142 “On approval of the list of commodities exchange and the minimum size of represented batches sold through commodity exchanges”.

Location: the Republic of Kazakhstan, Pavlodar region, Ekibastuz c., B. Momyshuly st., 23.

Director General: Korsakov N.N.

Financial performance

|

Indicator |

Measurement unit |

2019 |

2020 |

2021 |

|

Net income/loss |

mln tenge |

26,917 |

24,093 |

23,421 |

|

EBITDA |

mln tenge |

40,415 |

36,728 |

34.666 |

|

EBITDA Margin |

% |

43 |

36 |

34 |

Results of operating activities

|

Indicator |

Measurement unit |

2019 |

2020 |

2021 |

|

Coal production volume |

mln tons |

44.8 |

43.3 |

44.6 |

|

The volume of coal sales in the RK |

mln tons |

33.8 |

33.4 |

44.7 |

|

to own PP |

mln tons |

17.5 |

17.8 |

20.0 |

|

third party PP |

mln tons |

16.3 |

15.6 |

14.7 |

|

Coal export volume |

mln tons |

10.9 |

10.1 |

9.8 |

|

Major consumers |

“Ekibastuz SDPP-1” LLP, “Ekibastuz SDPP-2 Plant” JSC, Astana Energia” JSC CHP-1, CHP-2, “KaragandaEnergocenter" LLP CHP-1, CHP-3, “SevKazEnergo” JSC CHP-2, Petropavlovsk CHP-2, “Pavlodarenergo CHP-2, 3, Reftinsk SDPP, Troitskaya SDPP and Kurgansk CHP |

|||

Performance

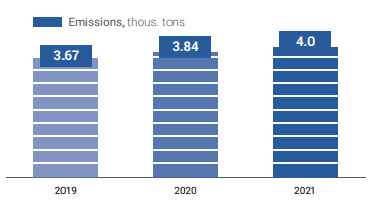

ENVIRONMENTAL PERFORMANCE

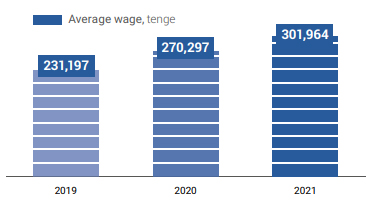

SOCIAL INDICATORS

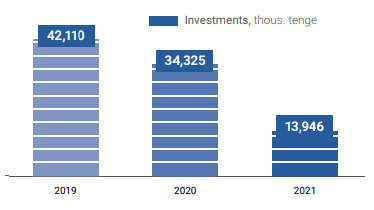

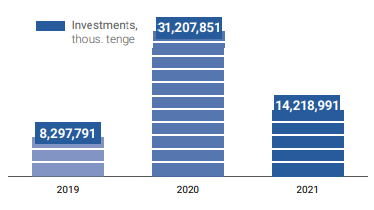

THE AMOUNT OF UTILIZED INVESTMENTS (50 %)

“Tegis Munay” LLP (“Samruk-Energy” JSC – 100%)

The purpose of “Tegis Munay” LLP business is to build ground infrastructure and equip the “Pridorozhnoe” deposit in the South Kazakhstan region of the Republic of Kazakhstan, to build a gas pipeline from “Pridorozhnoe” deposit to the Beineu-Bozoi-Shymkent gas pipeline, to produce, process and sell gas.

“Tegis Munay” LLP is an investment project of “Samruk-Energy” JSC, the profit is expected to be received from 2020-2021.

Location: the Republic of Kazakhstan, Almaty c., Askarova st., 40.

Director: Tastemirova G.

“Mangyshlak-Munay” LLP (“Tegis Munay” LLP – 100%)

“Mangyshlak-Munay” LLP, according to the Contract No. 4631-UVS-ME dated 30.07.2018 is the holder of the subsoil use right to conduct gas exploration at the Pridorozhnoe field in Turkestan region. The project involves the development of a gas field.

Its main task is the commercial exploitation of the field in order to make up the gas deficit in the region, create new jobs, develop infrastructure, and increase social assistance and tax deductions to the budget.

In accordance with the agreement on trust management of 100% of the share in the authorized capital of “Mangyshlak-Munay” LLP dated August 26, 2021 No. 1c/U/5-21, concluded between the Partnership and “Amangeldy Gas” LLP, 100% of the share in the authorized capital of “Mangyshlak-Munay” LLP was transferred to the trust management of “Amangeldy Gas” LLP.

Location: the Republic of Kazakhstan, Almaty c., Askarova st., 40.

Director: Zhylkyshiev K.B.

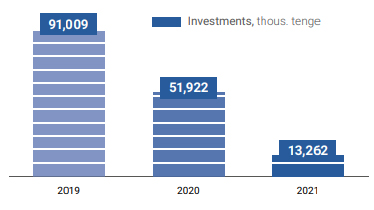

THE AMOUNT OF UTILIZED INVESTMENTS

“Energy Solutions Center” LLP (“Samruk-Energy” JSC – 100%)

“Energy Solutions Center” LLP is a service company for providing administrative support to “Samruk-Energy” JSC group of companies.

The list of services includes:

- it infrastructure maintenance services;

- services for the maintenance of internet resources;

- provision of transportation services;

- real estate management services (rent, purchase, construction);

Core business: special office services (staff outsourcing), IT services, transportation services.

Location: the Republic of Kazakhstan, Nur-Sultan city, Kabanbay batyr ave., 15 A, block B.

Director General: Begimov G.A.

Financial performance

|

Indicator |

Measurement unit |

2019 |

2020 |

2021 |

|

Net income/loss |

thous. tenge |

3 |

27 |

35 |

|

EBITDA |

thous. tenge |

68 |

121 |

137 |

|

EBITDA Margin |

% |

6 |

9 |

12 |

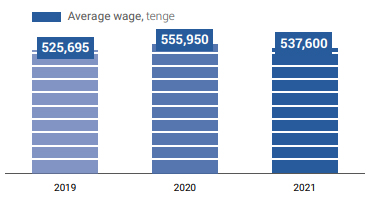

Performance

SOCIAL INDICATORS

THE AMOUNT OF UTILIZED INVESTMENTS (25 %)